Listen, it’s no secret that the demand for firearms has waned over the past year or so. Earlier this month, the top dog of the trade association for the firearms and ammunition industry said as much.

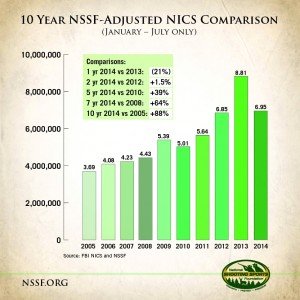

“To me, firearm sales data through the first seven months is saying our industry is experiencing a ‘new normal,'” said Steve Sanetti, the President and CEO of the National Shooting Sports Foundation. “Like a rocket ship, we’ve returned to Earth, but we haven’t gone back in time.”

Yes, sales are down. While that’s bad news for gun manufacturers and their employees — sadly, Remington Arms announced this month that it would layoff 105 workers from its upstate New York facility in Ilion, and no one wants to see that in a depressed economy — it’s actually good news for prospective gun purchasers.

With respect to Smith & Wesson’s earning, KeyBank Capital Markets said that it “is suffering from high inventories and low demand, as sales into the consumer channel declined 25.6 percent.”

Supply is high, demand is low, so hopefully prices will continue to reflect this “new normal.” But that may not apply to all firearms, because as Bloomberg Businessweek pointed out, “what really hurt Smith & Wesson last quarter was plunging sales of ‘long guns’ (down 67.2 percent), vs. handguns, which were down only 3.2 percent.”

So, if you’re in the market for a shotgun or rifle, now might be the best time to buy.

When people talk about the state and health of the firearms industry, they indubitably talk about the causes behind the market trends. Without question both the Obama administration’s anti-gun agenda and the wave of gun-control legislation spawned in the wake of the mass shooting at Sandy Hook Elementary School in Newtown, Connecticut, have played a large role in creating the spike in sales over the past six years.

But now, since gun-control at the federal level has nearly been vanquished despite Obama’s best efforts and the momentum gun-control activists had following Sandy Hook has faded, the urgency to go out and purchase a firearm for fear that it may be banned is no longer there. Hence the drop in sales.

To ask the obvious question, will the demand return to those unprecedented levels? Will the market switch back to a seller’s market?

No one can predict the future. But a 2016 Hillary victory would certainly increase demand. After all, it was her husband who presided over the last federal ban on so-called ‘assault weapons.’ There’s little reason to think that she wouldn’t aggressively try to do the same. Moreover, another tragedy on the scale of Sandy Hook might move the needle, heaven forbid.

In the meantime, expect to see prices drop a bit. Also, for nervous Nellies who believe that the decline in sales is a bad omen for the gun industry, there’s no reason to put stock in those concerns. Even with the sluggish sales, we’re still in the golden age for guns in America.

“Over the last decade, the market has spoken: Citizens around the country have exercised their constitutional right to purchase a great variety of firearms for target shooting, hunting and personal and home protection. I’m optimistic we’ll see a strong finish to this year,” said Sanetti.

“And contrary to the naysayers, both the violent crime rate and fatal accidents with firearms have decreased about 19 percent and 22 percent during the past decade which saw these great increases in the number of firearms being purchased by more Americans,” he added. “That’s the most gratifying news of all.”