(Editor’s note: This response piece was written by the NSSF’s Larry Keane. It was published first by NewsTime.com.)

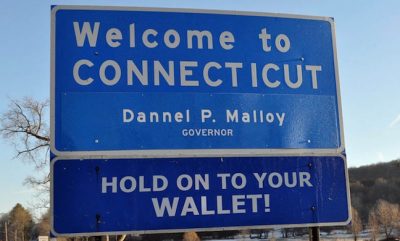

John Stoehr (“Time is right to talk gun tax”, Aug. 21) writes either in clear disregard or in ignorance of the economic damage Gov. Dannel Malloy and the majority in the General Assembly have already done to the state of Connecticut because they pursued a political agenda of passing highly restrictive gun control laws over good-paying jobs.

Here are the numbers:

- From 2013-2016, Connecticut lost 3,000 firearms-related jobs, even as the industry grew overall across the country.

- In-state wages dropped 36 percent while state tax collection declined 37 percent.

- Nearly $700 million was lost in positive impact to the state economy.

- Companies both left Connecticut and chose to move production elsewhere.

Looked at from another perspective, if the firearms industry had been able to contribute to state tax revenue at the same level as it did in 2013, Connecticut would have collected $140 million more than ended up in the coffers.

Despite this significant decline in economic contribution, Connecticut-based, firearms-related businesses in 2016 still paid $85,109,200 in state taxes. If a brand new, separate tax is imposed on legal firearms sales, we will see that number go down, not up. More jobs will be lost at in-state retailers.

SEE ALSO: Seattle Gun Tax Turning Out to be Another Miserable Gun Control Failure

All this would occur at a time when the state is falling further and further behind due to increasing taxes on everyone and everything due to our elected officials’ inability to get both spending and long-term debt under control.

It’s a pity. For a variety of reasons related to its poor governance, Connecticut is losing the very residents it needs to pay the bills and at a truly alarming rate.

Anyone who does not think that a new tax on firearms and the Second Amendment infringement it represents will not worsen this situation must work behind ivy-covered walls at a place like Yale.

About the Author: Lawrence G. Keane is the Senior Vice President and General Counsel of the National Shooting Sports Foundation with headquarters in Newtown. NSSF is the trade association for the firearms, ammunition and related industries.

For me, and tax on an item violates equal taxation. But I warned of this years ago when the people let cities and states tax cigarettes and alcohol. Once you let a politician realize income from taxing specific items, the floodgates will open, and here is a perfect example of that. Just like the cigarette and alcohol taxes have driven down sales of those items, this tax will do the same. Every criminal in Conn. must be rejoicing over this.