Buy Guns Not Gold

by Paul Helinski

|

| Is gold the investment you think it is? |

Imagine for a minute that the United States Treasury made a million dollar bill note. You know, like a hundred with Benjamin Franklin on it, but a million instead of a hundred. Then imagine that someone gives you one of those million dollar bills, tax free, yours to keep. The only other detail is that you aren’t allowed to spend any of the million bucks for ten years, but you can invest it in something or somethings for a potential return to live off of between now and then. Then, at the end of ten years you can only live off of the million bucks itself. You can’t keep any of the money you make between then and now after the ten years, and that includes a return on investing the million.

It may sound complicated but it isn’t. This is the story for many people facing retirement in ten years. They have a “nest egg” of principle and they need to keep the principle in tact for retirement, when they plan to live off of it. Until that time they would like to see a return on the principle, but the most important thing is to not lose that nest egg.

Would you take that million bucks and just keep it stored in that million dollar bill? Bank savings accounts have interest rates in the negatives right now and probably for the foreseeable future. You aren’t losing anything by not being able to earn interest on it. It’s not a bad little storage system, a million dollar bill. It is portable, compact, and you can hide it easily. Banks can fail, but do countries fail? Will that million bucks be worth a million bucks in ten years?

Would you buy gold with that million bucks? We all hear that gold is todays safest investment, but gold goes through some huge ups and downs. If you are smart you will most likely say that you would split up the million bucks across several forms of investment, to diversify your risk. But what is low risk and what is high risk today? Government bonds are thought to be low risk. You can even get some that adjust for inflation. But America is outspending its tax revenues by the trillions these days. Would you lend your money to a compulsive gambler with a AAA credit rating if you knew his income had been slashed by bad times and that he was going to continue to go to the casino with all of his borrowed money? What else would you call stimulus and bailouts other than high stakes gambling? And I don’t like the house odds.

No matter which way the economy turns, someone is going to lose. That goes for putting your money in gold, real estate, stocks, bonds, US currency, foreign currency, just about everything…

Except guns.

To start, let’s take a look at the fear that is feeding the gold frenzy. In order for that million dollar bill to become worthless, the whole country would have had to collapse or at least devalue its currency by an absurd amount. Strangely enough though, that is the thinking that is driving the frenzy to buy gold. You may not be part of this frenzy, because you think that you are safe with and FDIC insured bank account. But how many commericials for gold can you ignore. If banks continue to collapse evenfually the FDIC is going to need its own bailout. And what if your bank falls in the midst of a nationwide financial collapse?

Likewise the stock market. It may be up for now, but what happens when another staple of the American economy like Enron or Lehman come clean about their numbers and shut the doors? We’ve already seen billions and trillions in personal worth disappear in the stock market. Who is to say that your investment in stocks won’t crash and burn like Enron?

I’m not trying to play on fear. This world is extremely confusing right now and at the center of it is us, the United States of America. This article isn’t meant to be investment advice. I just feel that certain questions need to be asked that nobody seems to be asking. And if you are someone with a “nest egg” sitting in a bank, wondering if you should finally listen to those gold commericials and pull our investment out of dollars in the bank and put them into gold, there is some math you may want to do first.

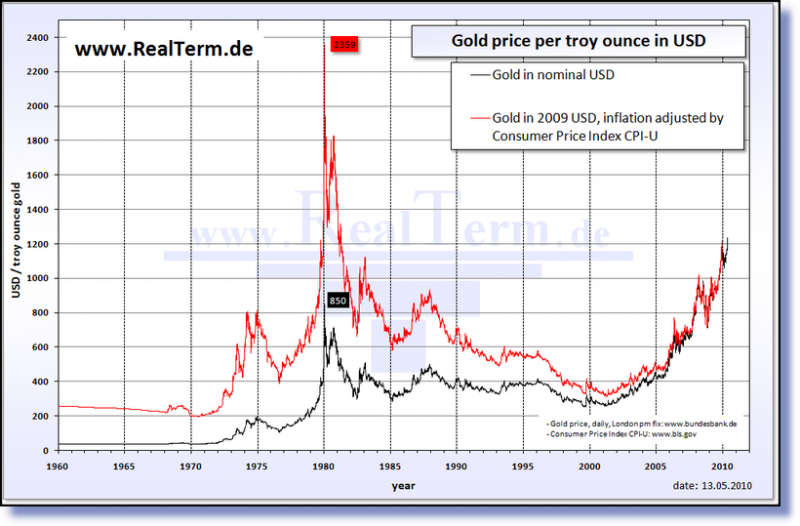

Today as I write this gold is holding somewhere around $1200 an ounce, where it has sat for over a month. This is up 183% over the last five years. The last time this happened, the average price of gold per year doubled from 1977 to 1979, then doubled again in 1980, to over $600 per ounce. By 1985 it had halved back to $300 and then bumped up and down to a low under $300 in the boom years of the late 90s. If you had bought gold in 1977 at $150 you’d still be sitting pretty if you had needed to sell your gold at the bottom in the year 2,000. But this isn’t 1977 and gold has already risen an average of 20% per year for the past five years. Radio ads will tell you that gold has no end in sight. But what if they are wrong? What if unemployment continues to rise and dollars become worth more, not less? Rampant inflation could be just an inflated sales pitch, trying to get us all to buy gold.

|

| The shocking history of gold and how risky it is as an investment today. |

Gold may never be worth nothing, but the chances that gold is going to spike to new record highs is doubtful. Already the market is being spooked by odd events that the media says could trigger a massive sell off. Gold hasn’t risen in a while, and since gold is always either rising or falling, the chances of it falling become more and more possible as the days move on. America would have to completely collapse for the world to lose faith in the dollar and let it rise to banana republic inflation rates. South America and China simply have nobody else to sell their food, junk and drugs to besides America. They are too invested in the dollar to see it fail.

Even as far as America goes, already the public outcry over spending has the politicians distancing themselves from bailouts and stimulus. Everyone is beginning to understand that we can’t spend our way to prosperity on credit. Inflation fears are probably overblown at this point, and coming out of the fall elections there will most likely be a wholesale backpeddling on all of the crazy spending that the politicians got away with already. America could go to the polls in November with a strong resolution that the “hope and change” experiment with a hardcore Chicago politician has failed, and we could elect a government that is truly for the people and by the people.

That’s why this article isn’t about the collapse of America. I’m not telling you to run out and buy more guns because I believe that America is on the verge of a financial apocalypse. It very well could be, and through very little fault of Obama. He didn’t destroy America in two years. It has been on its way for a long time. America doesn’t make anything anymore and we grow even less. Government itself contributes more to GDP than does manufacturing, and if government is forced to shrink with spending cuts, our already bad unemployment rate could grow dramatically. If it does, the opposite of inflation will most likely occur, deflation. That means that dollars are hard to come by and prices decrease severely because there is simply nobody with money to buy.

When I do the math and ask the questions of where America could go, I come up with a whole bunch of different answers. But they are split up into groups. I’d like to take a look at a comparison between putting money you need in ten years into guns, versus putting it into gold, and for that matter, other investments.

1. America Recovers and Enters a New Era of Prosperity

Yay! Let’s do this one first because it is definitely the coolest, and what we all want. America could come thriving back. We could resurge, proving that we really don’t have to make or grow much of anything here in our actual physical country, and that our service, healthcare and technology economy can truly thrive into the next millennium.

If America recovers and ten years down the road you want to start selling off the guns you bought now, you’d be in pretty good shape judging from history. Guns generally never go down in value unless they were purchased during the temporary political bumps like we saw in late 2008 and 2009, the “Obama bounce.” By now it is safe to say that the Obama bounce is over in the gun industry and guns have caught up, or down, with the rest of retail. Prices are back to normal and even ammunition is again available at pre-boom prices. If you buy guns and ammunition now you can be confident that you are almost definitely not overpaying for them at standard retail. There was no bounce in purely sporting weapons (deer rifles and hunting shotguns), and it has been safe to buy them as cheap as you will find them for a quite a while now. Deep discounts in sporting guns can be found nationwide. Historically guns go up in price at a level greater than inflation, so as long as you keep the guns locked in your safe with a Goldenrod, in new condition, your investment is safe.

If America does quietly bounce back over the next five years or so, retail is going to come back and retail for sporting guns with it. Guns are a high quality of life purchase and generally in good economies the gun industry is very strong. Even high grade “rich people” guns will be a great long term investment, which I’ll get to.

I’ll also mention here that as much as nobody wants it to happen, guns can go up in value very steeply over the course of your investment for one of these short bumps. Any newsworthy criminal or terrorist incident can do it, or if the current administration begins to rattle sabers about gun control, you may even be able to make a healthy return on your investment right away. But more likely if America recovers you will see the recent Supreme Court decisions used to overturn virtual gun bans in several states, which will also increase demand for guns. I feel that all of these factors add up to due diligence in assessing a possible investment in guns. Even in the best of times guns will be a healthy investment, with some extra potential for steep gains.

Gold has historically tanked out during healthy economy years. Fear is the fuel for the price of gold and if there is good consumer confidence gold goes down as fast as we have seen it go up. See the charts I have included here.

Unfortunately good times aren’t what we are mostly worried about here. Now let’s look at a couple different ways things could go bad.

Option 2: Rampant Inflation

This is a confusing scenario, which is surprising because so many people are putting their life savings into a giant gamble that rampant inflation is going to happen by buying gold. The thinking is like this. Big Obama government uses debt (not current taxes being paid to them) to print money that will flood America with cash and a false prosperity. They do this by hiring more government workers, doing yet more “busywork” road construction, cutting taxes on the middle class, making it easy to get mortgages again, lowering interest rates even more, etc. I’m not an economist so you’ll have to excuse my understanding of how this specifically happens, but at least I’m not being as general as the gold commercials.

Now, because there is so much money around, the prices of stuff goes up, because everyone is theoretically employed by these government practices so everyone has money for more stuff. Internationally, everyone loses faith in America’s ability to make good on the unbacked debt, so the dollar shrinks in value as compared to other world currency, and of course, GOLD IS WORTH MORE DOLLARS, protecting its owners from the devaluing of the dollar.

This means that a piece of gold you buy today for $1,200 you will be able to swap for $2,000 then, after this rampant inflation occurs. The “no end in sight” thinking is based on world liquidity. You have China, India and other nations with national treasury vaults full of paper dollars and IOUs from the US Government. If America appears to not be able to back all of this money, because we are in the process of a complete collapse (like what is happening to Greece right now), all of those countries are going to crazy to trade any amount of dollars for gold, because the gold will at least retain value.

What a mess huh? I’m not going to get into theories about the value of gold if such a thing occurs. And if is of course up to you to even bet on the collapse of the greatest country that ever was. Lets just take a look at the value of guns in this scenario, because it is here when you talk about runaway inflation that gold is the most compelling as a safe haven for your net worth.

Rampant inflation means that stuff costs more and dollars are worth less. Well, the last time I checked, guns qualify as “stuff,” which means that they too would by nature be worth more dollars. When the euro spiked a couple years ago our own Italian gun makers got killed because the price of their guns had to go up just because of exchange rates. It took more dollars to buy what one euro would buy, and this translated to the consumer. If the dollar shinks to record lows, guns will simply be worth more dollars.

In comparison to gold, guns are at the bottom of their value right now because of a staggering economy and the complete tanking of retail in America. Gold has risen by unprecedented amounts for a long time. If I am going to buy something now and sell it in five or ten years, I’d rather something that I feel I am buying at its bottom than what could be its top. Call me silly, but I don’t see how guns won’t bring a better return than will gold.

Now we’ll go into what politically looks a lot more likely than runaway inflation.

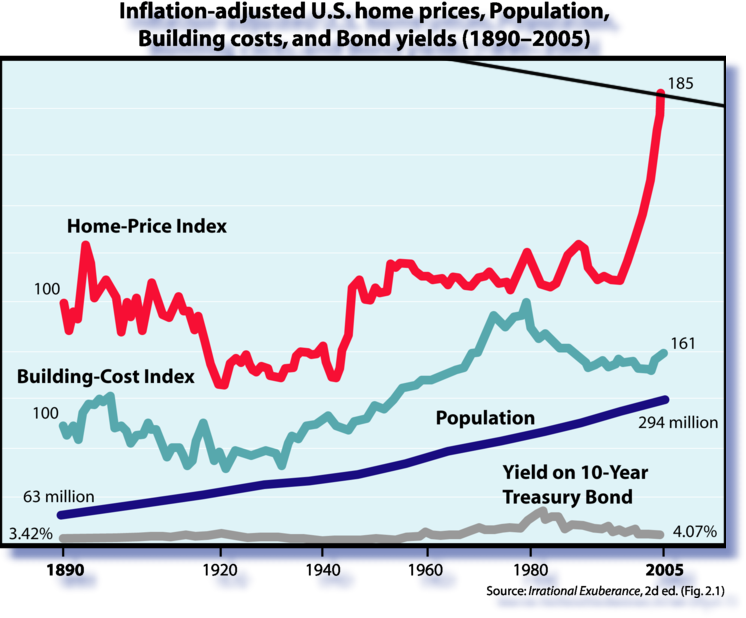

Option 3: High Unemployment and a Defacto Depression

This is the scariest of all because here is where the “nest eggs” of most people will be completely destroyed. Home values plummeted in the Great Depression. The stock market lost almost all of its value and everyone was out of work. I think that this scenario is what everyone is truly worried about. It is just very difficult math to do when you look at gold.

Gold was not in play during the Great Depression. The price of gold stayed within a dollar of itself ($34 an ounce) from 1933 to 1968, and before that it had stagnated even cheaper for four decades. It wasn’t until the 1970s that gold became a popular investment and fluctuated drastically, fueled by fears of double digit inflation at the time. We have no evidence that any physical thing you can buy will have any value if the unemployment problem in America continues to worsen, let alone gold that has been rising on a fear diet for a long time. Nobody is going to swap China gold for US Government debt in a depression, and most likely the worldwide depression that our depression will cause will make all of that irrelevant in China. They will shutter all of their new factories and go back to subsistence farming. The government will have dollars they may or may not want to unload for gold, but someone has to pay for the trip over.

Not to be too overdramatic here, but think about these factors as they relate to gold. “Gold is never worth nothing” is the quote that we hear over and over again. But if the only buyers for gold are foreign governments swapping paper dollars for gold, how are those dollars supposed to get here? What percentage will the people moving dollars and gold back and forth to China take from you? Will all of your hopes that you invested in gold turn into disgust when the gold brokers make all of the money?

Guns and gun values were not something that was a factor for investment in the 1930s either. But I believe that the Obama bounce of 2008 has given us some very important and conclusive evidence of the investment value of guns and ammunition, even in the hardest times. The year of 2008 was not a year of prosperity. Neither was 2009. The Obama bounce happened in the midst of the worst economic uncertainty in the history of most of our lives. Still we ran out and bought guns and ammunition at an insane level, on the concern that we wouldn’t be able to at some point during the next four years.

Imagine what America will do when the drive by media reports that police forces may have to abandon their posts because state treasuries are empty. Already cities across the U.S. will face a projected shortfall of $56 to $86 billion between 2010 and 2012, according to a report from the National League of Cities. Some cities in California have already disbanded their police force, leaving public safety to the already overburdened county law enforcement.

A depression of sorts, or even worse a full blown depression, will mean a cut of public services. High unemployment means lower tax revenues, which means states not able to pay their bills, which means that services, such as parks, fire and police, will be cut regardless of the outcome. It isn’t just California. New York, and other bastions of out of control government entitlements half already slashed public services. It is a national epidemic already.

This, coupled with unemployment itself of course, will lead to higher crime rates, newsworthy higher crime rates, and this is going to make people scared. By then most people aren’t going to be worrying about how much spot gold is going for today. They just want to be able to protect the two loaves of bread and 2 pounds of butter they just got off the FEMA truck, if the FEMA truck still would even exist at that point.

Civil unrest is something that the government is already planning for, though most people don’t want to believe it. Civil unrest is part of a destabilization. If a depression happens, there will be rioting, there will be crime, there will be people crazy to own guns to protect themselves. This is something that could happen today, let alone if things get worse.

Already, just since the Heller case brought the great American tradition of gun ownership into the public eye, droves of “city people” who knew not from guns have shown up at the gun rental counter to get a piece of what they have now come to understand is the foundation of American freedom. Many of them have come to the conclusion that they were unknowingly on the wrong side of the issue.

Most likely if you are reading this you are one of us, and either own guns or have owned guns. But there is better than two thirds of America out there that don’t own guns right now. If America doesn’t recover and continues to tumble, it isn’t going to affect everyone. Even a 25% unemployment rate means that 75% of people have jobs. Everyone who has something to lose is going to want to protect it. The Heller case opened their eyes to gun ownership. They are going to buy guns, and if you are one of the 25% who were gainfully employed in 2010 and can’t find work in 2017, this is going to create domestic demand for your guns.

You will not need a broker to sell your guns. It will be a direct consumer to consumer sale and you will get top dollar in whatever the dollars of these difficult times are worth.

Now lets back up and look at other investments a bit. Dollars (paper, not bank invested) aren’t a bad place to store your money planning for a depression scenario either. I wouldn’t take that million dollar bill, because it some point the socialists will make you turn it in for an 80% loss because they will have political support to punish rich people. But there is no such thing as a million dollar bill. Hundreds, fifties and twenties will spend just fine in a depression, and they will be worth more than they are today. So if you feel that this is the path America is headed down, stuff that mattress or fill up your safe.

Electronic (banks and stocks) or promisary (bonds) methods of keeping your money probably wouldn’t be a good choice here. Call me silly, but the easiest and quickest way to lose value is when all the money is funny money. If I am going to plan for a high unemployment, depression-like era, physical cash or things is where I want to have my money stored.

The issue is uncertainty. We don’t know which way anything is going to go. China has already been accused of currency manipulation. With so many hands in the pot with so many varied interests in the outcome, who is to know which way things are going to go. This article is meant to argue for guns as a generally good choice of investment, no matter what America’s future. Because most likely, because overnight drastic change is so rare throughout the course of history, what acctually happens won’t be newsworthy at all.

Option 4: Nothing Happens

I think there is a pretty good chance that we are going to keep going on the same path we are on for a long, long time. From the looks of things, we are past the worst of the government bailouts and the dollar is going much better of late on world markets. I think there is a better than good chance that we are just going to coast along for a while and let things slowly improve, similar to what happened in the Jimmy Carter era. So how does gold look if that happens?

As world fears about our national debt ebb, and all of those nations with treasuries full of American greenbacks breathe a sigh of relief, world interest in gold is going to slip away. With it will go the price of gold and buyers of gold. It may never be worth nothing, but I can promise you, if you buy a Remington 700 today on GunsAmerica, you will be able to sell it for more than you paid in ten years. You will never be able to say that about gold if you buy it now at what would be its top. Don’t knee jerk and buy gold just because you can with the masses of sheep. Think, and go buy guns.

Which Guns to Invest In?

This question is not as complicated as you might think. The short answer is “buy what you can get a great price on.” Guns are almost 100% commoditized. There is an actual book you can buy with values called the Blue Book of Gun Values. If you are already familiar with guns somewhat and you have a Blue Book in hand, you aren’t going to make a mistake. From there it really is what interests you and what do you feel you can become an expert in.

Black guns and handguns, especially subcompacts and other CCW options, are still not at what I would call their bottom, though AK-47s and standard AR-15s have come down to what may be the bottom. There is still a heavy trickle of new gun owner buyers entering the market for these guns today, and that new level of demand may become the new bottom. People have to stop playing video games at some point and live real lives.

I feel that the best buys are in sporting arms, and as long term investments they pose no greater risk than black guns in being able to sell them (right now is not a good time). In a disaster situation where everyone just wants a gun, the cheaper sporting guns are going to be easier to sell than the tricked out black guns. Handguns will be at a premium of course, but only to those who can afford them. What you buy is largely going to be a product of how much storage you are willing to maintain, and that can be a big concern.

Let’s go back to our example about the million dollar bill. I have now decided to take that million bucks and invest it in guns. I could buy 1,000 AR-15s, but where am I going to keep 1,000 AR-15s? If I stuff My Liberty 64 gun Fat Boy safe I can get about 100 guns in there. Just handguns I could probably get 300 without boxes (make a run to Costco for packages of cotton sox). The safe itself is well worth the investment, but how many safes can I fit in my living space? Not many. In this case, for the million bucks I need in ten years, I would diversify and buy some of the more expensive guns of our day. A couple Barrett .50 cals, a few FNH SCARs and maybe a few of those half minute tricked out ARs from TacticalRifles.net will reduce my safe requirement substantially. And I would bet you that million dollar bill that none of those guns will lose a penny in value no matter how bad or good things get.

One caveat here is that you have to buy and store ammunition for every gun in your investment portfolio. How many rounds per gun varies. For a deer rifle, two boxes of 20 rounds per gun is fine. For anything with a 20 or 30 round mag, 200 rounds is the minimum. Handguns, 100 rounds per gun I think would be minimum required, including some +P hollowpoints. Shotguns, combat or sporting, no less than 20 rounds of buckshot is the minimum, but more likely 50. Ammunition is not entirely back to normal prices, but if you are buying minimums for now the loss in the difference in price will be nominal, and the potential gains are great.

If you were buying and selling guns during the Obama bump you may not think that my ammunition requirements are truly required. There is a difference though between a bump caused by fear of not being able to buy a weapon later and a bump caused by people thinking that there may be a riot in front of their house in the near future. Nobody cared if they couldn’t buy ammo in early 2009 after the election. It is the guns that they ban, not the ammo. If you want to be able to turn over your guns as an investment when you want, with complete confidence in your liquidity, take my advice and store some ammo for them.

That is why I think that sporting guns shouldn’t be left out of your potential investment, especially if you are trying to decide a safe haven even hundreds of thousands of dollars. You can buy a lot more used deer rifles for $5,000 than you can ARs, and if you don’t have a lot of money to store hundreds of dollars worth of ammo the deer rifles may be the better investment. With all the press and energy that has been expended to sell the AR-15 in 5.56mm rifle as a deer rifle, what has been lost is that a deer rifle is just as good at home defense as an AR-15 in most cases. And if Wal-Mart still has .243 on the shelf and no 5.56, a deer rifle is what people are going to want to buy. One civil unrest event could create a flood of demand for firearms that this country has never seen. Black guns, handguns and ammunition will disappear faster than they did during the Obama bounce. Nobody besides gun dealers will be selling their guns, and when those guns are gone there will be no guns left. If in such a world you will need to eat from your savings, a gun of any kind is going to bring you much more return than any other investment, as long as you have bullets to go with it.

High Grade Guns

The division you have to make with sporting guns is when it comes to high grade guns. This is for the few people who got this far into the article who have hundreds of thousands of dollars they don’t want to lose when the banks lock them out. Now don’t get me wrong. If you are reading this and you have lots of money to protect, I don’t think you are stupid enough to take my advice about investing. I don’t even have a college degree.

Uncertainty is the issue, not smart investment advice. When you actually do the math to the end on any one of many scenarios that could happen to the United States in the next ten years, the only investment that holds up under all situations is guns.

Where high grade guns come in to this picture is on the issue of return on your investment. If you are not alarmist (which I personally am not), protecting your assets for survival isn’t the issue, because you have enough to diversify and protect yourself under the worst of conditions. Return on your money, making it work for you, is where your head is these days. There aren’t a lot of options out there with a decent return and little risk.

I would argue that diversification into high grade guns is a great investment decision. People are clamoring to find “blood in the water” with real estate deals, but there is a lot of competition for those deals, so much so that the truly good deals don’t exist for all but a few who stumble upon them. Historically real estate has been a great investment after bubble bursts because even on the crash it doesn’t fall below its pre-crash price. But take a look at the Great Depression. Real estate tanked out for almost a generation.

|

| It is tricky to pick an investment when the closest thing to our current risk level happened almost a century ago. |

You won’t find a ton of “blood in the water” when it comes to high grade guns. This is the playground for millionaires, real ones, but like all of retail, anything to do with sporting guns is somewhere around its bottom right now. Shotguns in the $3,000-$50,000 range are all around and people are ready to deal if you have cash. High grade gun shops and specialists aren’t steeply discounting their inventory severely (because they know that the guns are a better investment than dollars), but there are plenty of individuals and small dealers with money tied up in high grade guns who will firesale them. It is a win, win. They need to pull the cash out and you get an investment with a few extra points of buffer built in.

Just to differentiate between high grade guns and antiques, there is a world of difference between investing in one over the other. High dollar antiques are made up of a fixed number of firearms that have been documented since the 19th century and have travelled from hand to hand in the collecting world for years. You are buying something that is purely speculative, based on rarity vs. demand. An antique is not necesarily crafted more finely. It isn’t made from nicer materials, expert craftsmanship or anything else that has historically meant real value in retail goods. I won’t say antiques are a bad investment. You just have to be an expert to invest soundly in them, and fakes abound. Some of the worst embarrassments in our industry have come from very recognized names in the industry, arrested for selling fakes.

When you buy a high grade gun as a consumer, you are paying tens of thousands of dollars for a shotgun or a rifle for a reason. The hand craftsmanship and artistic skill that went into making the gun are stuff of legend, as well as the wood, and there just aren’t a lot of people in the world who can make this stuff. The value of these guns isn’t based on the whim of an auction bidder, or worse, a pair of auction bidders. If you want this handmade gun with work by this hand engraver who only does four guns per year, you have to pay for it. The value of what you are buying is built into the gun, not a speculation of what it is worth. Generally you are dealing with name brands that are never faked, because the people who made the gun are still involved in the industry and know who made that particular gun that you see advertised.

This Beretta S3 EELL currently on GunsAmerica for $29,500 is a known commodity to consumers, and people interested in buying it aren’t calling the seller to question its value. They are trying to decide between investing in this particular gun that is worth every penny or another that is worth every penny, depending on which engraver they prefer or what pictures are engraved on the gun.

|

| High grade guns are valued for the worksmanship and materials vested in the gun, not the whim of antiques bidders. |

This SO10 is listed at $190,000 and it is the same story. And even this 687 Silver Pigeon at only $3,900 is exactly the same way. Different grades, different engraving, different wood, with clearly defined steps on the ladder that everyone understands.

Three guns, three vastly different prices, and all of them will likely be worth more in ten years. Read the descriptions of all of them. You will see that this is a very established market with established buyers, and the buyers are not entirely dependent on the health of the US economy. Japan and Europe, and now even South America have a value for these fine guns, and it is a market that does not fluctuate with the tide of stock markets and currency trading. High grade guns in the hundreds of thousands even will never be “funny money.” There are few sounder investments.

One Day This Will All Be Over

Not a day goes by that you don’t see someone rattling sabers that America is on the brink of destruction and that America is on its way out. Because political futures are at stake in November, figuring out the truth is a guaranteed mess. Today alone there are headlines that the government hid a tax on gold coins in the health care legislation and that there is a proposal to tax all currency trading. It just gets more confusing and politicized as the days go by. Like anything, you can only predict the future by what has happened in the past, and historically gold has been a very risky investment after spikes, while guns have always maintained a steady rise upward, despite economic woes forward and back. The government confiscated gold during the depression, and no supreme court decision got in the way. At least with guns we have the 2nd Amendment when the government tries to confiscate them. Ultimately one way or the other, the uncertainty we currently reside within is going to be over and the scales will be tilted one way or the other. Until then, I suggest you ask the questions I have asked here and judge whether it is guns that are the safe haven that they are trying to sell us with gold.

I agree firearms are a commodity or wide range. There are the mass produced “fords” and the rarer and more valuable Bentleys & RR’s. I have no doubt — especially after Sandyhook — that guns will always have increasing value, and not just assault rifles and auto pistols. This is the time for those who bought low to sell high, but even when the scare dies down the value of firearms is unquestionable. Look at any nickel news or internet gun site and it’s obvious. I do get tired of the SHTF mentality. A fine gun is just like a beautiful antique european clock (pre industrial revolution) or a ’67 Camaro. They just go up in value — faster than inflation. Nicely written article — MU

I have known for a long long time that guns and ammunition are a much better investment than gold. Specifically, a lot of cheap guns ($200-$2,500) if you have the space to store them securely. The government is constantly attacking gold investors and gun owners because if the government fails they will have less power over us citizens with their limited human resources if we are self-sufficient and poised to form a new republic(s) from grassroots. When you look at the real world with your own eyes, you can see that survival is not rocket science and it doesn’t mean carving a hole into a mountain, either. Survival is ensuring that you don’t have to ask “what am I going to do now.”

Great colum except for one big problem, if you live in california. Try buying a hand gun. Their is so much crap you havr to do it make you not one to buy a gun or rifile, also have you seen the law in selling a fire arm to much hasel. Years ago i made xtra money buying and selling firearms not today not worth the grief. as far as gold goes i buy and sell and make a much faster profit i will stick to GOLD.

dude could you please repeat that in english? where did you learn how to write? China?

many people are typing on smartphones these days, or voice to text, or have autocorrect that makes its own mistakes.

Give people a break.

Paul-

Your article makes sense to me even though it is a bit long. And, if things go bad, gold will not be useful. 10 years ago I had a gentleman trying to sell me gold coins at 60% of the going value. Thought it was too good so I called a friend who is in the precious metals business. He informed me that several Middle-Eastern persons were heavy plating lead coins which were exact counterfeits. You couldn’t tell by the looks. The lesson is, if things go bad, I will never accept a precious metal coin. And if things are that bad, my Remington 870 with 18″ barrel and number 3 buckshot (or slugs) will help me survive. If you know how to handle it, this is the best urban weapon around. Don’t forget, in war and peace, 95% of all shots are within 25 yards. Truth being known, probably within 5 yards. And I am not selling it; I’m giving it to my kids. A great investment!!!!

Have always believed in having guns for self defense in case of riots, hurricanes, etc, now have sturdy bolt actions, Garands a lot of ammo etc in addition as futher protection and as trade matieral. Have seen the result of hurricanes with electric down for a week or so, and no access to banks,gas statlons,stores etc.Would recommend a minimum two weeks of foodstuffs and dog or pet food etc as the supermarkets looked liked they would after a riot. Full to three quarters a tank of gas in each car you own and all the medications you can put away. Plenty of antibiotics are thrown away needlessly, keep them along with a print out on what they are good for. along with pain medications that you may have. Saw in person a fight, between a guy with a broken bottle and one with a concealed handgun over how was first in a gas line, after five days, when a gas station just opened. The guy with the pistol prevailed, which brings to mind the saying, never bring a knife to a gun fight. Also a few thousand dollars or as much as you can take out of your bank account, to keep on hand. Forget gold for the time being,people understand the value of Benjamin Franklins, more than a once of gold which many can’t afford. Ammunition is also good currency. Just thoughts for now

Whoops! After reading my comments several times I still missed a mistake

before hitting the submit button. It is the word began eleven lines down. I

should have written begin.

To Scott Gold above: You mentioned that you own some pawn shops. I live

in the Austin area. If you are around here please email me. I would like to

take a look at your guns for sale. Kent [email protected]

Thank you , Paul, for a very well written article. I have a little quirk that helps me decide if

I continue to read through an article, a manual or a book to gain knowledge or information.

That quirk is that I have a knack for spotting spelling and grammar errors in everything I

read. If a piece of writing is riddled with mistakes, I have little faith in the information being

put forward and tend to ignore it. A writer who doesn’t care to edit shows me he cares little

for what he has to say. I read all of your piece and trust that what you say is what you believe, and

is worthwhile.

The only problem here is that I have no money to invest in guns. Do you sell guns or only gun safes?

I do need several guns; two handguns for protection, at least one shotgun and a couple of hunting rifles.

I have one ounce of gold. I missed my chance when it was going for $1,800/oz. I’m watching for it

to go back up and then I’ll sell it and apply that towards some guns. But if I see the price began to drop

I will sell…fast. I haven’t visited your site to shop, but when I finish here I’ll go take a look to see if you

sell guns.

Again, Paul, your article was very well written. I recall only one mistake, however, if you are under 45 I’ll forgive

you that one error. I am seeing it more and more on the Internet by American English writers. Now, go

search through your article and try to find that one I mentioned. Here in my comments can be found, written

correctly, the one item I am referring to. Have fun searching, Paul. I am joking of course. I’m not a jerk. I am just

an old man with too much time on my hands.

Thank you, Old Cap’n Kent

oh my………………..what are u smokin???

I have to say, when I was directed to this article I thought it was going to be an ad for something to buy from a company selling garbage like on late night TV. I was wrong! We recently got into buying and selling guns as our company recently acquired an FFL for one of our pawnshops. Before that I never paid much attention to the price of guns since I buy what I like and didn’t give it much thought. I bought my first .357 S&W 25 years ago. Once we got the license, we decided to do research and see what prices were like so we could buy and sell at a profit. To my astonishment the prices I paid for my first gun 25 years ago went up 100%! It doubled in price! It’s the same identical gun with the same identical model number being sold today but it was worth twice the money! I decided to check all the weapons I ever bought and still had and sure enough, it just about beats out every investment there is out there in the last 10 years! It seems the only way you can do better is to get extremely lucky at some other investment or to have invested in something like gold and held on to it for the last 20 years.

I never looked at guns as an investment until earlier this year. I then went out and bought books for firearms published in the 1980s and matched the prices to those realized today in auctions and book values and I found that this article is 100000% correct in just about every way! I looked at guns for protection since I was a boy but it took me 47 years to realize that it’s an investment and those who can get into it can make WAY more money than they can with anything else in this world unless of course you get extremely lucky. With 10% unemployment, I know at least 1 out of every 10 people that are not too lucky right now and any one of us can end up like that 1 person out of 10 is. As long as guns can protect, and every little boy wants to be a “cowboy” or “policeman” of which both require guns, the desire for them and investment growth in them will grow thus proving this article once again to many more people!

Good writing!

This is the best article I have seen in years! It gets right to the heart of the matter and people should heed the advice given here. I have known this was coming for the last 20 years and everyone thought I was nuts. Now they are asking my advice on what to buy and how much ammo is needed for each weapon. Many are thinking for themselves again and looking with open eyes and minds. Thanks for a great article without all the BS.

Guns are a great investment if you value the lives of your family these days but silver and gold may have some use if things go really bad. Just be sure to have some bullet casting gear. A bullet works even if it is silver, gold or platinum.